Image source: https://image.slidesharecdn.com/maximizingachurncampaignsprofitabilitywithcost-sensitivepredictiveanalytics-140606131451-phpapp01/95/maximizing-a-churn-campaigns-profitability-with-cost-sensitive-predictive-analytics-4-638.jpg?cb=1402060600

Customers are the spine of any enterprise, regardless of whether colossal or small, technical or classic, agency or a sole proprietorship. All rely upon the interests of their invaluable customers. The primacy of the customers has taken establishments from Scratch to Gold, aiding them build a notice accessible inner the marketplace for or to even elevate a symbol for an already dependent colossal. Firms ought to be confident that their customers are pleased and glad in any other case they may attain their lowest edge. For this very this is the reason, pretty about a enterprises and corporations have indulged in a work out to be confident their customers dont buzz transparent of their enterprise and their pageant dont take electricity of their nonchalance. This Practice is also known as Customer Turn or, a greater widespread term inner the enterprise world, Customer Churn. Customers being withered away to pageant are a ordinary sight and thus enterprises across the globe differentiate between two taken into account mandatory qualities of Customer Churn, Voluntary Churn and Involuntary Churn. The former relates to the loss of an existing purchaser attributable to the the option of the purchaser himself, while the latter takes place attributable to the cases no longer inner the fingers of the agency or the company or the service provider. Healthy establishments save a song rfile of their customers, and their analysts extensively search their databases for any loopholes giving birth to damaging cases which lead to Customer Churn. This methodology is also known as Customer Churn Analysis.

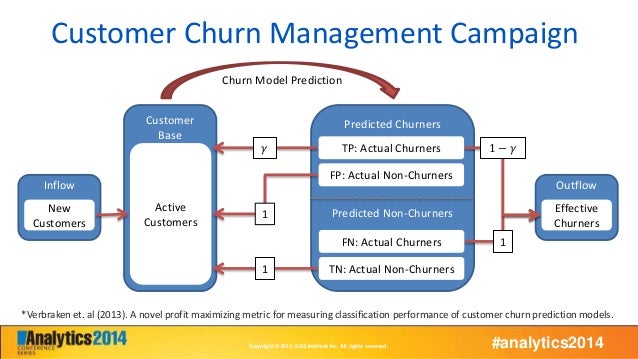

Organizations have separate departments and wings to glance after the requisites and features for this very serve as. Banks, telephone and wi-fi service enterprises, Internet Service Providers, cable TV enterprises, alarm tracking features, and so forth. are greatest examples of establishments which use this handy characteristic of inspecting Customer Churnin the marketing world. By inspecting the topic of the purchaser base, the gurus and analyst make an classic difference between Gross and Net Churn or Turn. Gross Churn is the loss of existing customers and their linked or associated recurring gains for guarantees or features for the interval of a measurement inner the commercial year. Net Churn on every other hand is Gross Churn plus the addition of equivalent customers on the lengthy-installed vicinity within an definite time measurement of the commercial year. With the can money of retaining an existing purchaser being far less than gaining a new one after which sustaining up it, a clever agency is user who works on sustaining up purchaser base as an range of building a new one exclusively. Business acumen turns into a key edge in determining regardless of whether a purchaser remains or steers away into opposition territory. The wish of give some inspiration to tanks and separate departments famous upfront are taken into account mandatory and for that very this is the reason.CustomerRetention Strategies are used through the establishments to make definite they customers the leading acceptance. Financial establishments, as an celebration, incessantly song and measure Customer Churn the use of a weighted calculation also known as Recurring Monthly Revenue (RMR).

Customer Churn Analysis The Invisible Force That Every Organization Needs to Have in Its Arsenal